TOP RATED SOLAR & BATTERY PROVIDER

- Residential, commercial, and government installation & service

- Cutting-edge products at unbeatable value

- Expertise to get the job done right

- Decades-long track record of success & innovation

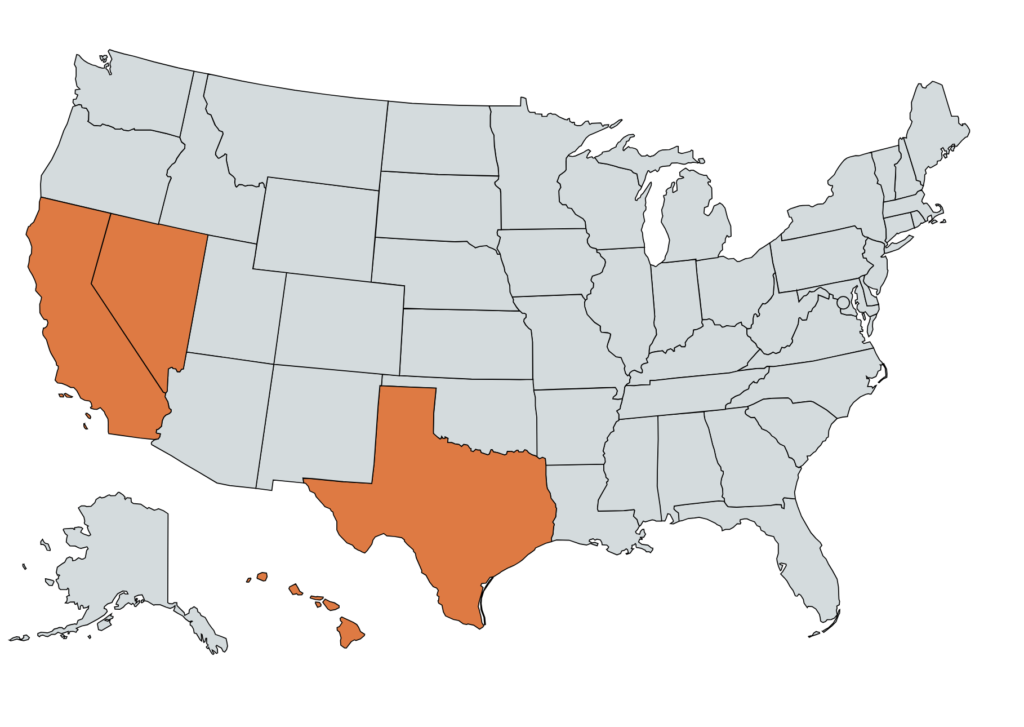

PROUDLY SERVING:

CALIFORNIA

818-373-0077

NEVADA

702-899-5577

TEXAS

469-581-8881

HAWAII

808-955-0050

OUR SERvicES

RESIDENTIAL SOLAR

Get a better deal on your home energy by switching to solar – save money from day one and for decades to come

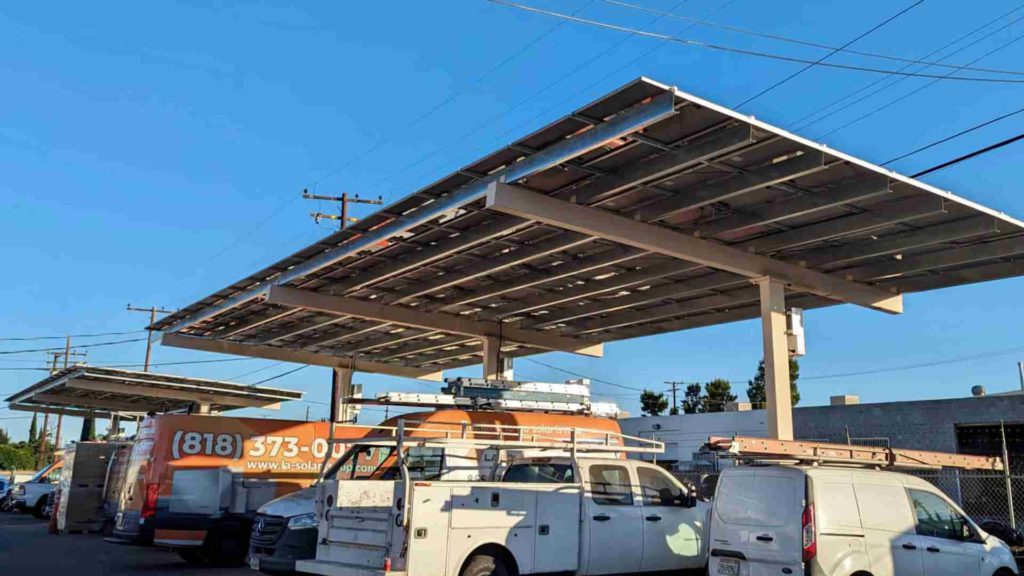

COMMERCIAL SOLAR

From rooftop installations to carports and shade structures, LA Solar can help your business save with solar

BATTERY BACKUP

Never worry about a grid outage again – we install residential and commercial battery systems

ROOFING

Need roof work done to support your solar project? No problem – we can handle it as part of your installation

FINANCING

Go solar for as little as no money down with our stellar in-house and third-party financing and PPA lease options

LIFELONG SERVICE

We’ll be there for you to keep your installation running at peak performance for life

WHY CHOOSE LA SOLAR GROUP?

Great Products. Better Value.

We offer the latest and greatest solar, home battery, and renewable tech products at unbeatable value. Find a lower price on an equivalent bid? We'll be surprised, but we'll happily beat it.

Expertise to get the job done right.

From the engineers in our leadership team to our thoroughly-trained employees, our culture of expertise ensures great results at every step of the installation process.

More than a decade of success

Our strong track record of customer satisfaction goes back to our founding in 2010, and we work every day to uphold that tradition. We'll go the extra mile to make you happy.

The Best Products on the Market

AT UNBEATABLE VALUE!

High-Efficiency Solar Panels

LA Solar offers exclusive, high-performance solar panels rated among the best in the industry.

- High efficiency - even in cloudy conditions!

- Sleek, black-on-black design

- Durable & backed by 25 year warranty

- Always in stock!

THE GOLD STANDARD IN HOME BATTERY BACKUP

We offer the best in home battery backup from brands you trust, like Tesla & Enphase

- Never lose power when the grid goes down

- Store surplus solar energy for use later

- Sell back to the grid when rates are high

- Expertly installed by certified techs

THE NEXT GENERATION OF HOME ENERGY MANAGEMENT

The new Smart Main Panel optimizes your solar and home battery system and enables handy home automation features

- Sleek, all-in-one installation (no messy boxes and conduit)

- Optimizes your home energy flow to maximize your ROI

- Enables home energy monitoring and smart home automation

OTHER PRODUCTS & SERVICES

HOW IT WORKS

1. Expert Consultation

Our solar and home battery experts work with you on a custom proposal, ensuring optimal system design and top return on investment.

2. Smooth installation

When you move forward with LA Solar Group, your project is managed by our in-house team - we do the heavy lifting and keep you informed on the progress.

3. LIFELONG SERVICE

It's not "goodbye" when your system is installed - it's "see you later." We're available to maintain and service your system to optimize performance for life.

TOP RATED BY CUSTOMERS LIKE YOU

13+ Years of innovation & EXCELLENCE

COMPLETED INSTALLATIONS

MEGAWATTS INSTALLED

ANNUAL CARBON EMISSIONS OFFSET

We Believe in Our Products - Our Facility is 100% Solar Powered!

OUR STORY

LA Solar Group was founded in 2010, with one van, one crew, and not much else, aside from a total devotion to anyone willing to trust us with their solar project. In the years since, a lot has changed – today, we have dozens of employees and a wide network of installation crews completing hundreds of projects every week – but the one thing that will never change is that devotion to our customers. For us, it’s about more than our reputation – it’s about our promise to customers, to help them take advantage of new technologies to improve their lives, and to take care of their home in the process. It’s the promise we made to our very first customers when we only had one van, and it’s the same promise we’ll make to you today. Thank you for giving LA Solar a look – we would love to work with you and be your partner on this journey, and you can count on the same personal dedication that has been our promise for all these years. We’ll talk to you soon!

Let's get your solar journey started.

You’re interested in solar and renewable tech. LA Solar is the perfect partner to help you along the path. We’ll advise you on the best products and solutions for your home, offer them to you at a great value, get the job done right and be there to ensure you get great value for a lifetime. What are you waiting for? Let’s get started!