Blog

The solar industry has long been a symbol of progress, providing a pathway to affordable and accessible clean energy through federal tax incentives. However, a significant change is on the horizon. A recent congressional vote to phase out the generous 30% solar tax credit after 2025 will make solar systems more expensive for both consumers and providers. If you have been considering making the switch to solar energy for your home, this important moment requires your attention. It is crucial to understand what this proposed change means for your financial planning and how you can still take advantage of substantial savings before this critical opportunity closes.

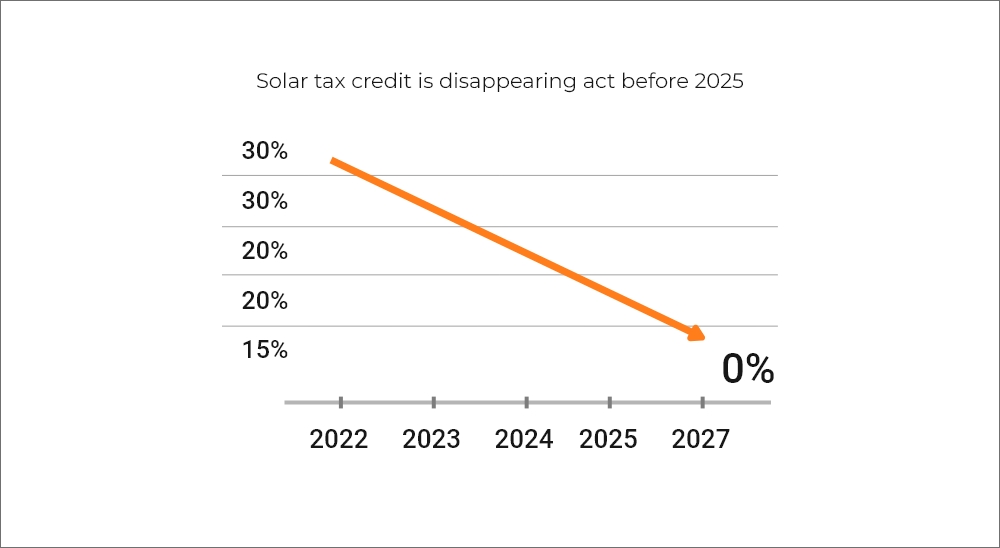

Currently, the federal Investment Tax Credit (ITC) is a key factor in the adoption of solar energy, allowing homeowners to deduct 30% of the total cost of their solar systems from their federal taxes. This important incentive was originally intended to remain at this level until 2032, providing a stable long-term framework for solar investments. However, the situation is changing quickly. A recent budget proposal, which has been passed by Congress, aims to significantly accelerate the phase-out of this credit. If this proposal becomes law, the credit could see substantial reductions or even complete elimination by the end of 2025. This shift would fundamentally change the financial considerations for future solar installations.

How This Impacts You

The potential reduction or elimination of the 30% federal tax credit has significant implications for homeowners considering solar energy:

Higher Out-of-Pocket Costs: Without the substantial 30% credit, homeowners will directly bear a much larger portion of the overall installation expenses. This increase in upfront cost could make solar energy less accessible for many, impacting budgeting and financial planning for clean energy investments.

Decreased Return on Investment (ROI): The Solar Investment Tax Credit (ITC) has been instrumental in accelerating the payback period for solar systems, allowing homeowners to recoup their initial investment more quickly through tax savings. Without this credit, the time it takes to achieve a positive return on investment will inevitably be extended, making solar less attractive financially for some.

Slower Industry Growth: A reduction in financial incentives is likely to temper the demand for new solar installations. This potential slowdown could have a ripple effect across the entire solar ecosystem, impacting job creation, stifling innovation in solar technology, and potentially hindering the nation’s broader clean energy goals and ambitions for decarbonization.

The message is clear: time is of the essence! If solar energy has been on your radar, even as a distant consideration, 2025 should be your target year for installation. Proactive steps taken now can ensure you secure significant savings:

Get Pre-Qualified Early: The entire solar installation process is multifaceted and can be time-consuming. From the initial consultation and obtaining detailed quotes to navigating permitting processes and completing the physical installation (which may include roofing work or electrical upgrades), the process can span weeks or even several months. Initiating the pre-qualification now will give you a vital head start.

Ask About Bundled Savings: We offer comprehensive solutions that extend beyond just solar panels. Inquire about packages that combine solar with essential home improvements such as battery storage systems (for energy independence), advanced roofing solutions, or integrated EV charging packages. Bundling these services can often unlock additional financial incentives and maximize your overall savings.

Secure Financing or Rebates: The federal tax credit is a powerful tool, but it’s not the only option for savings. Actively investigate local utilities, state-specific programs, and available rebate funds. Many of these programs are designed to further offset installation costs and may specifically target low-income households or homes located in designated fire zones, providing crucial support where it’s needed most.

Get Installed Before the Deadline: To secure the full 30% federal tax credit, your solar system must be fully installed and operational by December 31, 2025. This hard deadline underscores the urgency of making your decision and initiating the process without delay.

Procrastinating on your solar decision could lead to a substantial financial loss, potentially thousands of dollars in federal tax incentives that are currently available. Furthermore, delaying means facing another year of unpredictable and often increasing utility rates, which can continue to erode your household budget. While it’s possible that new policies or incentives might emerge in the future, there is no guarantee that they will be as financially beneficial, accessible, or straightforward as the current federal ITC. The current opportunity is tangible and established.

Despite the evolving policy landscape, investing in clean energy remains a wise long-term financial and environmental choice. The urgency to act has never been greater. Whether your primary motivation is achieving energy independence, realizing significant long-term cost savings on your utility bills, or making a commitment to environmental sustainability, now is the crucial moment to secure your solar future.

Don’t miss out on this unique opportunity! Take charge of your energy future today. Call us at 818-373-0077 or visit www.la-solargroup.com to schedule your personalized consultation. Your future self will thank you for making this proactive choice towards a cleaner and more affordable energy solution!

Federal Solar Tax Credit Overview – U.S. Department of Energy

A government-backed guide explaining eligibility, how the credit works, and what’s changing.