Energy production with solar and energy storage has completely changed the relationship property owners have with their utility company. As states across America are pushing to mandate sustainability and contribute to climate change, energy companies see an opportunity to speed their efforts to introduce technology that will help states meet their environmental policies. 2018 energy storage market trends show that the latest technology making a difference in people’s lives every day is battery storage.

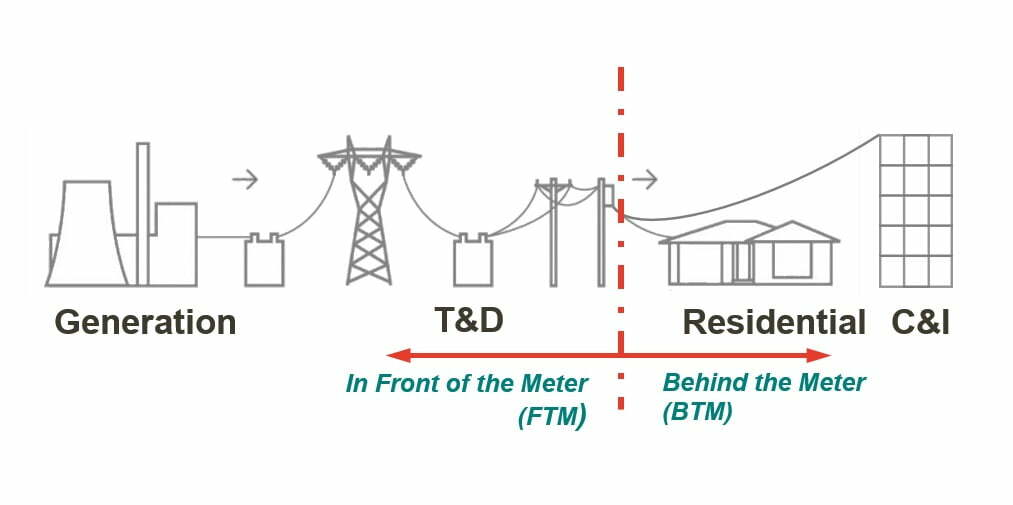

To date, utility scale projects have been the largest segment in energy storage. To better understand the market trends, let’s first consider the the two segments of storage.

Source: www.energy-storage.news

(T&D – Transmission and Distribution of utility grid energy to end-users)

Front of Meter (FTM)

This segment of energy storage is based on the utility company that integrates their own storage systems with their existing grid. Because it’s storage capabilities are not be used by the end-user (ie: existing building or home owner), the energy from the storage system is not metered. The scale of this segment is large, mainly in the Megawatt range. Why would utility install energy storage for themselves? To balance the demand for power from their end-users and prevent grid failure.

Behind the Meter (BTM)

This segment of energy storage is based on the unit being installed on site at a residential or non-residential property. It’s called behind the meter because the storage unit is placed after the utilities meter that’s already installed on the property. This way, the power generation will be metered and/or fed into the grid allowing the utility to measure and record data in order provide their Net Metering and Feed in Tariff programs. On Grid Solar PV systems that are installed on homes and commercial buildings are considered as BTM.

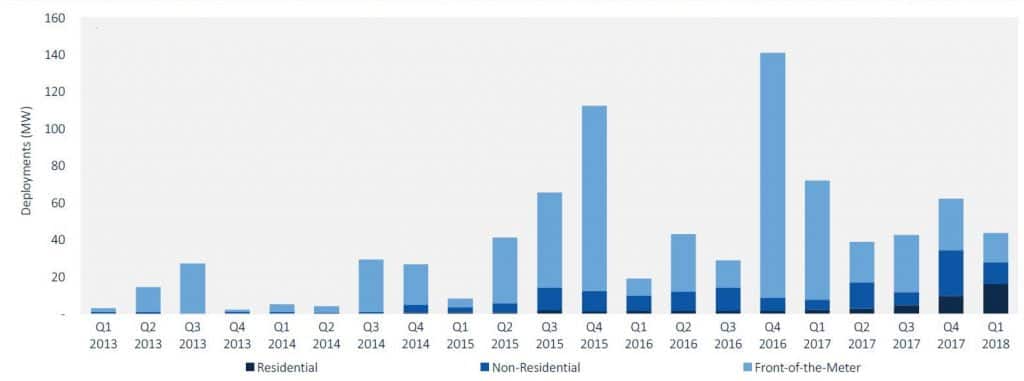

2018 Market Trends

The latest news on the demand for energy storage has been promising despite a 30% decline in the first quarter of 2018 from the forth quarter of 2017. Year-over-year, the market declined by 39%. According to the latest U.S. Energy Storage Monitor report from GTM Research and the Energy Storage Association (ESA), the decline is due to a large scale FTM battery storage project, Aliso Canyon that came online in 2017. The Aliso Canyon project brought more than 70 Megawatts of energy storage on-line.

U.S. Quarterly Energy Storage Deployments by Segment (MW)

Source: Green Tech Media

2018 saw residential BTM battery storage deployments (units that have been installed and commissioned onsite) at an all-time high in the first quarter. 36 megawatt-hours of grid-connected residential energy storage systems were deployed in the first three months of this year, which is equivalent to the amount of residential storage deployed in the previous three quarters combined. California and Hawaii together deployed 74% of residential storage units during the quarter.

Nationwide, energy storage systems for residential homes made up 28% of all deployed power for the quarter. Non-residential properties that installed battery storage deployed 21% of the power. That’s a total of 126 megawatt-hours (MWh) of energy storage deployment in the first quarter of 2018 from 100.2 MWh in quarter 4 of 2017. GTM Research is forecasting that annual residential energy storage deployment will exceed 100 MWh by 2020.

So what been driving the demand of energy storage this year? The utility and low up front costs. The solar revolution forced utilities to restructure their net-metering policies and time-of-use plans making the over solar investment less attractive their existing customers with solar power who now want more independence and control of their energy use and expense. Incentives such as the SGIP program in California have also helped make battery storage more affordable, which also contributes to the demand.